this post was submitted on 02 Dec 2024

983 points (98.6% liked)

memes

10664 readers

1724 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

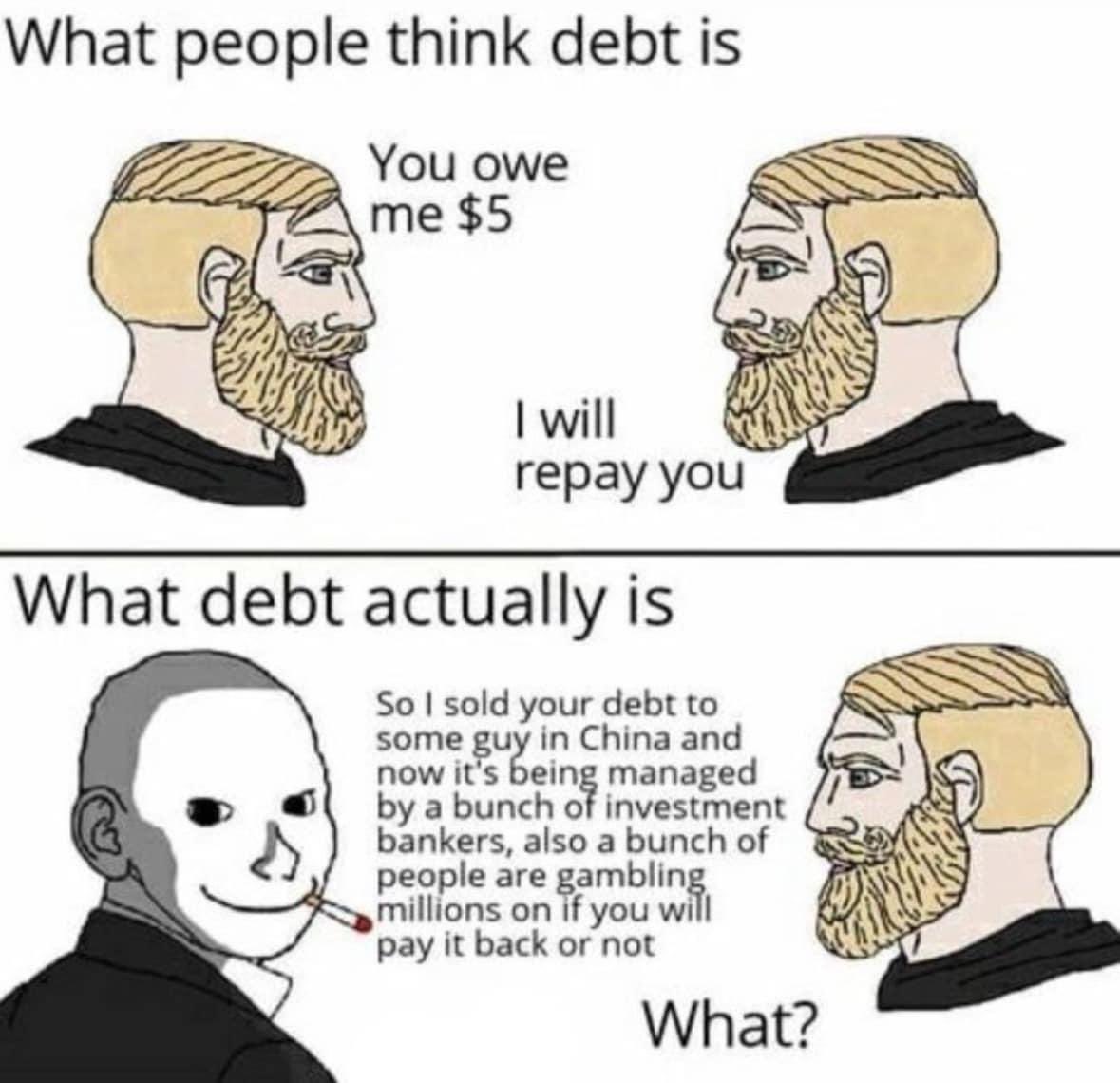

Company A sells widgets for dollars made from raw materials bought in yen.

Company B sells woggles for yen made from raw materials bought in dollars.

Both companies can reduce their risk by agreeing to exchange yen for dollars at an agreed fixed value. No one is gambling. Everyone is reducing their risk.

Interest rates, some companies may have floating income they wish to swap for long term fixed, and others may have too much long term debt which has a volatile mtm value.

Counterparty risk, usually mitigated by diversification. Companies pool their specific risk for a lower, but more certain, general risk (and use clearing houses).

Liquidity risk. Only a problem if you need to sell something quickly. Here there are gamblers taking advantage. There's no-one that naturally wants to take the other side of illiquid assets.