this post was submitted on 21 Mar 2024

1139 points (97.3% liked)

Privacy

32100 readers

703 users here now

A place to discuss privacy and freedom in the digital world.

Privacy has become a very important issue in modern society, with companies and governments constantly abusing their power, more and more people are waking up to the importance of digital privacy.

In this community everyone is welcome to post links and discuss topics related to privacy.

Some Rules

- Posting a link to a website containing tracking isn't great, if contents of the website are behind a paywall maybe copy them into the post

- Don't promote proprietary software

- Try to keep things on topic

- If you have a question, please try searching for previous discussions, maybe it has already been answered

- Reposts are fine, but should have at least a couple of weeks in between so that the post can reach a new audience

- Be nice :)

Related communities

much thanks to @gary_host_laptop for the logo design :)

founded 5 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

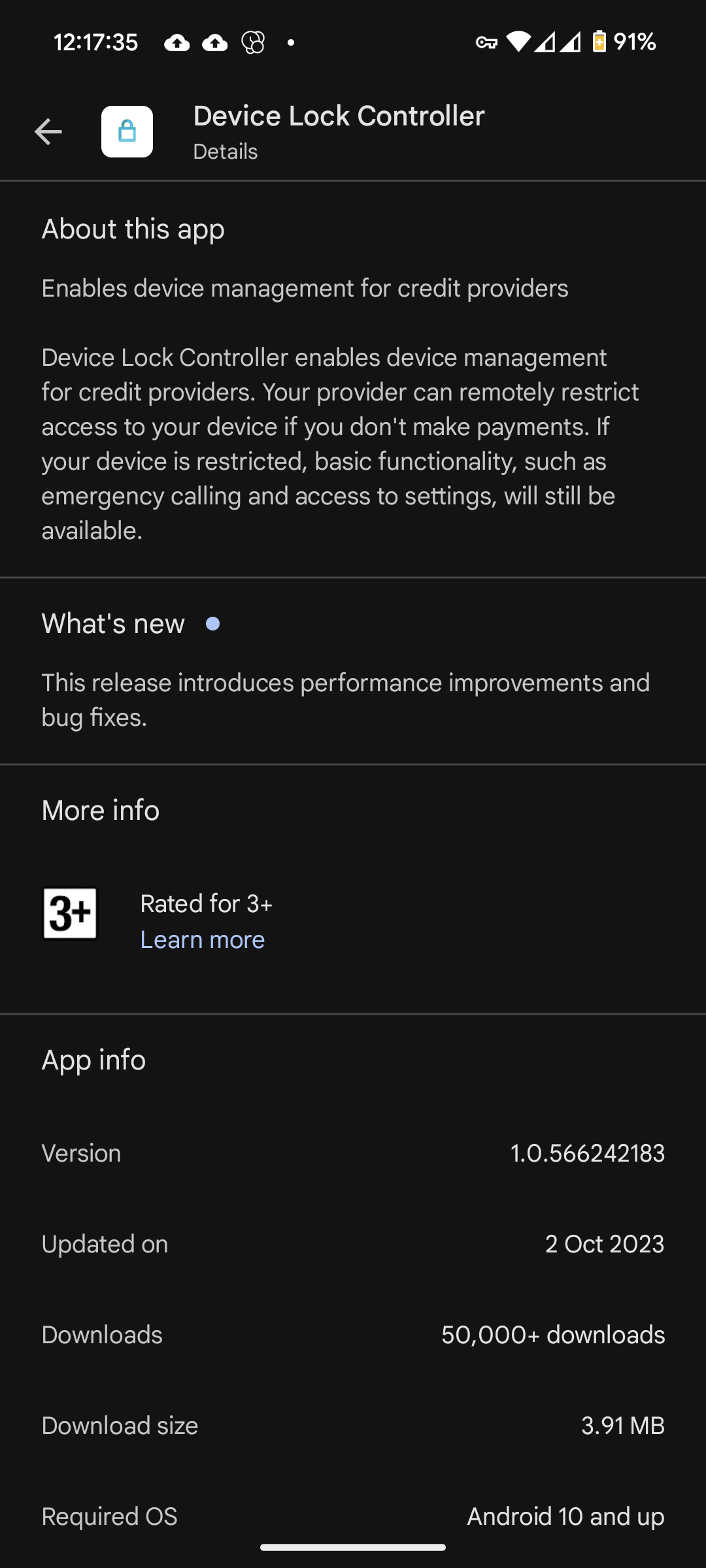

All your points are sound. The issue that I have with this is that remote disable functionality is not necessary to achieve any of these aims. Before they were connected to the internet, people were still able to rent/lease autos and the world managed to survive just fine. There were other ways for lenders to get remunerated for breaking lease terms - they could issue an additional charge, get a court order for repossession, etc. Remote disable was never needed or warranted.

So let's start by considering the due process here. Before, there was some sort of process involved in the repossession act. With remote disable however, the lender can act as judge, jury and executioner so to speak - that party can unilaterally disable the device with no oversight. And if the lender is in the wrong, there is likely no recourse. Another potential issue here is that the lender can change the terms at any time - it can arbitrarily decide that it doesn't like what you're doing with the device, decide you're in breach, and hit that remote kill switch. A lot of these things could technically happen before too, but the barriers have been dramatically lowered now.

On top of this, there are great privacy concerns as well. What kinds of additional information does the lender have? What right do they have to things like our location, our habits, when we use it, and all of the other personal details that they can infer from programs like this?

There are probably lots of other issues here, but another part of the problem is that we can't even start to imagine what kinds of nefarious behaviors they can execute with this new information and power. We are well into the age where our devices are becoming our enemies instead of our advocates. I shudder to think what the world would look like 20 years from now if this kind of behavior isn't stopped.

Perfectly stated! The moralizing story kind of serves as cover, as a complete blank check to excuse practically any behavior of the lender, without any limiting principle.

Right - they say that they're just going to use it to defend their "property rights". In practice, they're going to use it for a whole lot more than just that....

Exactly. These types of changes grant corporations extrajudicial power.

I don't disagree with anything you say. I think it's worth mentioning that the cost of enforcement directly informs the cost of a lease/rental situation. The cheaper they can enforce the contract, the less they can theoretically charge. If they had to get a court order to lock your phone or repo your car, they'd make it more expensive or be much more selective about who they lease/rent to. This maybe enables more people to have phones or get cars?

I swear I'm not rooting for team "aggressive manipulative business behavior widens opportunities for the less well off". Gross. Kind of how I hear about globalization of manufacturing stuff - "they get paid pennies!" "yeah, but that's more than before the factory came? look what they can buy now" I know that's a overly broad generalization but you see those arguments.

Of course! I hope you didn't read my comment as hostile. I read yours as sort of a devil's advocate type of argument and was just trying to point out the logical flaws in it. I'm glad that you didn't hesitate to voice a contrary opinion. The points that you raise are interesting... and it's always good to consider both sides of the argument, even because it just helps us hone our own arguments. You could certainly argue that this is just another enforcement mechanism. It's just that it comes with a lot of unintended consequences, which most people will overlook, and they'll inevitably be used in ways that we didn't anticipate, long after the fact that these kinds of mechanisms become commonplace.

Regarding the reduced cost of lending: sure, in theory they could lower the prices. In practicality, will it? Any time we see cost-reducing developments, it usually ends up resulting in higher profits for the vendors moreso than better competition and lower prices for consumers. Look at how car manufacturers are just letting electric vehicles sit in their lots because they refuse to accept what buyers are willing to pay. The corporate types really, really hate to lower prices on anything for any reason. So I would be surprised to see something like that happen, even though it's still theoretically possible....